As summer draws to a close, the local housing market remains somewhat unsettled. This is due to persistently high interest rates that have caused buyers to pause and sellers to hold onto their pandemic-era mortgage rates, as well as low inventory increasing competition for the available listings. Sold home prices in some areas have begun to see year-over-year price increases in relation to the slowdown that hit the market at the end of last year.

Windermere’s Chief Economist Matthew Gardner remarked on this trend. “Historically, the number of homes for sale slows in August,” he said. “Where sales did occur, prices rose between July and August in King and Pierce counties.” Gardner also described these conditions as “very unique times” in the housing market.

While these conditions may be challenging to navigate, sellers are still finding success with correctly-priced listings. New listings are attracting multiple offers and often sell over list price. Buyers who come prepared with strategic offers and a willingness to waive contingencies can break into the market with the guidance of a savvy broker.

King County was one of the regions that saw year-over-year price gains. The median price for a single-family home rose 0.7% from $899,999 in August 2022 to $906,250 last month. Condos saw even bigger gains, likely due to their better affordability for new homebuyers. The median price for condos in August was $525,000, up 8.25% from $485,000 the same time a year ago.

The Seattle market hasn’t quite caught up to its pricing from this time last year. There, the median price for single-family homes in August was $899,000, down about 3% from $927,000 in August 2022. On the other hand, the condo market saw a 10.5% price increase year-over-year, rising from $520,000 in 2022 to $575,000 last month.

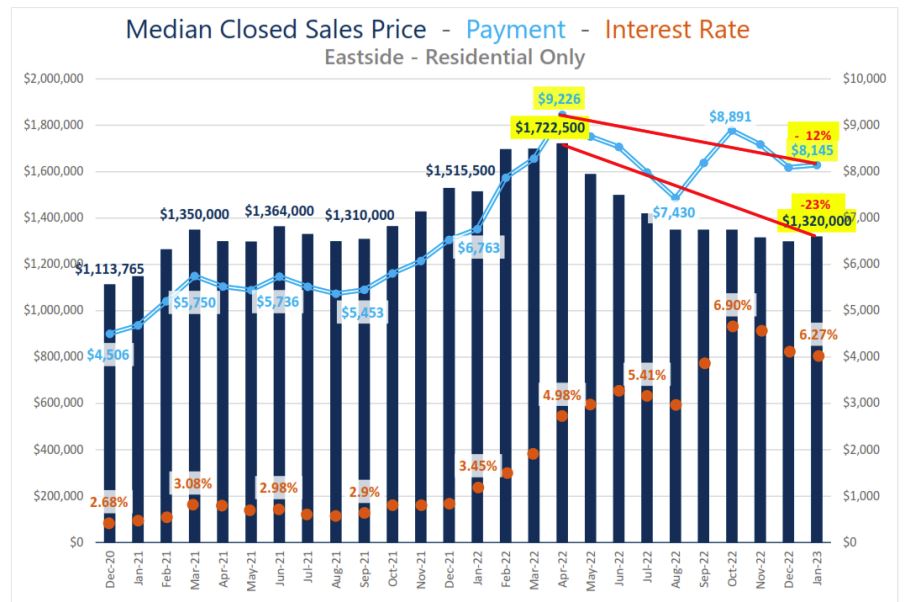

Eastside median sold prices fared better. After a somewhat sluggish summer in terms of pricing, last month the median price for single-family homes rose to $1,453,000. That’s an increase of 7.6% from $1,350,000 in August 2022. Condos in the area also saw price growth, with median sold prices increasing 5.4% from $569,000 last year to $600,475 in August.

Like Seattle, Snohomish County also hasn’t caught up to its 2022 prices, though this is likely because the county had fewer fluctuations in the last year and may be experiencing the typical end-of-summer slowdown that is common in the housing market. There, the median price for single-family homes was down 2.6% from $749,999 last August to $730,563 this year. The condo market was virtually unchanged in pricing, increasing from $474,999 in August 2022 to an even $475,000 last month.

In all the areas mentioned above, condos generally saw the most notable price gains. This is likely due to their greater affordability for first-time homebuyers and those in the median price-bracket. With interest rates still fluctuating, many buyers are rethinking their plans and may be pivoting to the condo market, thus driving up demand and prices.

Matthew Gardner sees the current real estate market as still “lack[ing] direction,” due to the ongoing interest rate issues. He says “it likely won’t find its footing until mortgage rates start to pull back, which I expect to see as we enter the fall months – and assuming the U.S. economy continues to moderate.”

The remainder of the year will set the tone for how the market looks in 2024. Until then, your Windermere broker can help you navigate these changing conditions and find a strategy that’s best for your buying or selling journey.